Why VCs are Chasing AI Speed at All Costs

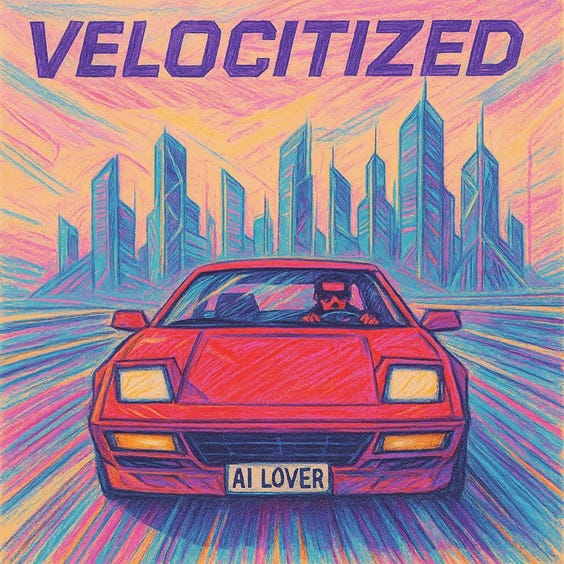

Raising VC capital in today’s market is a tale of two cities. The AI “haves” and the non-AI “have nots”. Behind this trend is a psychological trap that’s reshaping the VC landscape: “Becoming Velocitized.”

The term “velocitized” comes from driving safety. It’s what happens when you cruise at high speeds for too long. You get numb to the pace, and suddenly, dropping to a normal speed feels painfully slow. You misjudge risks because everything blurs into the rush.

Replace “speed” with “growth,” and you’ll see how this applies to VCs in the AI era. Companies like OpenAI, Anthropic, and countless others are scaling at unprecedented rates and hitting billion-dollar valuations in months, not years. User adoption of new products is happening at an unprecedented rate, funding rounds are closing in days, and revenue multiples can only be described as defying gravity. It’s like flooring it on the Autobahn.

But here’s the catch: Once velocitized by AI’s hyper-growth, every other sector looks sluggish. Fintech? Healthtech? SaaS? Biotech? Building steadily and de-risking over time with solid models and sustainable economics isn’t interesting anymore. In comparison, they feel like crawling in traffic. VCs, hooked on the adrenaline of AI deals, start passing on “slow” opportunities that might actually deliver long-term, durable returns. The world of “triple triple double double” is no longer good enough which makes raising capital difficult for almost every solid non-AI opportunity in today’s market.

Don’t get me wrong, AI’s potential is massive. But as fast as these companies are growing, key questions loom:

Durability: Many AI firms rely on massive compute resources and data moats, but what happens when the hype cycle cools? We’ve seen bubbles before where early winners faded fast without defensible barriers.

Economics: The unit economics often look shaky or are unknown. Training models costs fortunes, margins are thin amid fierce competition, and customer retention is unknown.

Consolidation: End-users (businesses and consumers) are in “try everything” mode, testing dozens of tools. But inevitably, they’ll consolidate their AI stack or be more discriminating about what they buy and how much they pay. When that happens, standalone AI startups could face a shakeout, with winners taking all and losers vanishing.

I’ve seen this velocitization firsthand. VCs who once prized patient capital now chase AI term sheets with FOMO-fueled urgency. Founders in non-AI spaces report deals stalling because “we’re not growing fast enough.” Investors, numb to 100% YoY growth, demand moonshots that mirror AI trajectories.

This mindset has ripple effects.

For Founders: Pressure to pivot to AI, even if it doesn’t fit.

For Investors: Over-concentration in one sector, which amplifies systemic risks and increases the odds of an eventual crash.

For the ecosystem: A talent drain to AI opportunities, starving other innovations.

Full throttle all the time? That’s how accidents happen. Valuations will pop, portfolios will crater, and VCs will write about how it was obvious but they had to play the game on the field.

It’s difficult to recognize when you’re velocitized. It’s even more difficult to do something about it because it requires conviction to play the long game while everyone else is celebrating their short-term wins. AI is thrilling, but being velocitized can have nasty consequences.